The more YOU share the more chances you have to win a $250 Amazon ® Gift Card! Each month, a new winner will be selected and Mariner Finance will donate $250 to Jeffie’s Choice to fight against hunger!

After a successful 2017 Sweepstakes, we launched our 2018 Sharing is Caring Monthly Sweepstakes. Instead of only 1 month of Sweepstakes last year, we decided to have sweepstakes from now on every month in 2018!

What is Jeffie’s Choice?

Jeffie’s Choice is a nonprofit organization created in memory of Jennifer “Jeffie” Ann Moss Johnson. Jeffie was passionate about maintaining a healthy lifestyle. As an active runner who competed in multiple races, it was essential for her to maintain a healthy diet. While health and nutrition were a big part of her life, she wanted to instill these values in other’s lives as well. Jeffie’s Choice was founded by Jennifer Ann Moss Johnson‘s three children; Josh Johnson, Elizabeth Rohme, and Sandra Lowe. Jeffie’s Choice is an organization we are very passionate about and proudly support. Our monthly donation to Jeffie’s choice of $250 will provide 1,000 meals to the food insecure people in the communities we serve.

How do I enter the Sharing is Caring Monthly Sweepstakes?

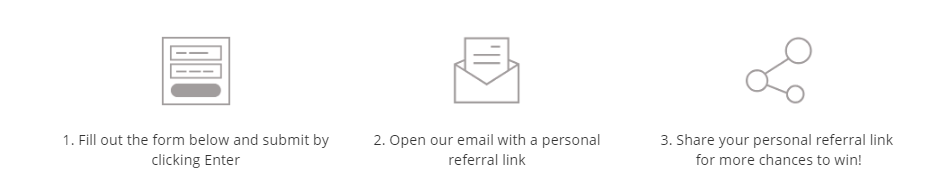

It’s easy! Simply follow the steps outlined below and on the Sweepstakes Submission Page. To increase your chances of winning, open our e-mail with a personal referral link and share this link with your friends on Social Media, by e-mail or text.

What are the rules?

Each entrant may submit one entry each month. You can gain additional entries by sharing your code with friends! Each friend that also enters using your code will give you an additional entry. Official Rules for the Sharing is Caring Sweepstakes

How do I know if I win?

Each winner will be randomly selected on or around the first Monday of each month. Be sure to check your email, as winners will be contacted by email. Prizes are to be claimed within 72 hours or the prize will be forfeited and another entrant selected.

I’ve won! Now what?

The prize will be awarded to the person named in the entry. The Confirmed Winner will be required to submit valid identification to Sponsor, to execute an Affidavit of Eligibility, and to execute all waivers and release agreements required by Sponsor, where legally permissible, prior to being awarded a prize.

An entrant may only win a prize one (1) time per twelve (12) month period. Entries do not roll to subsequent Promotion Periods. Each monthly confirmed winner will be announced on our website and social media.

Need some inspiration to use your gift card? You could use it to buy an appliance for the kitchen, supplies for finishing up an indoor house project, or to surprise someone else with a gift. #SharingIsCaring -It doesn’t matter what you choose, because the choice is yours!

Follow us on social media to stay up-to-date on #SharingIsCaring Sweepstakes!