Personal loans customized for you!†

Personalized loans up to $25,000†

No fees if you are dissatisfied and return your money in 15 days.**

Checking offers uses a soft credit inquiry with no impact to your credit score.*

Why choose us?

Simple application process

Typically takes less than 5 minutes to complete and submit your loan application online.

Personalized offer

Mariner’s offers are personalized based on your needs, and checking your offers will not impact your credit score.*

Satisfaction guarantee

No fees if you are dissatisfied and return your money in 15 days.**

In the community

Learn how Mariner gets involved in the communities we serve across the country.

Learn more

Explore a personal loan near you†

Whether you want to consolidate debt, pay your bills, or travel to your dream destination, Mariner Finance is here to help you. Explore our personal loans today and move one step closer to meeting your financial goals.

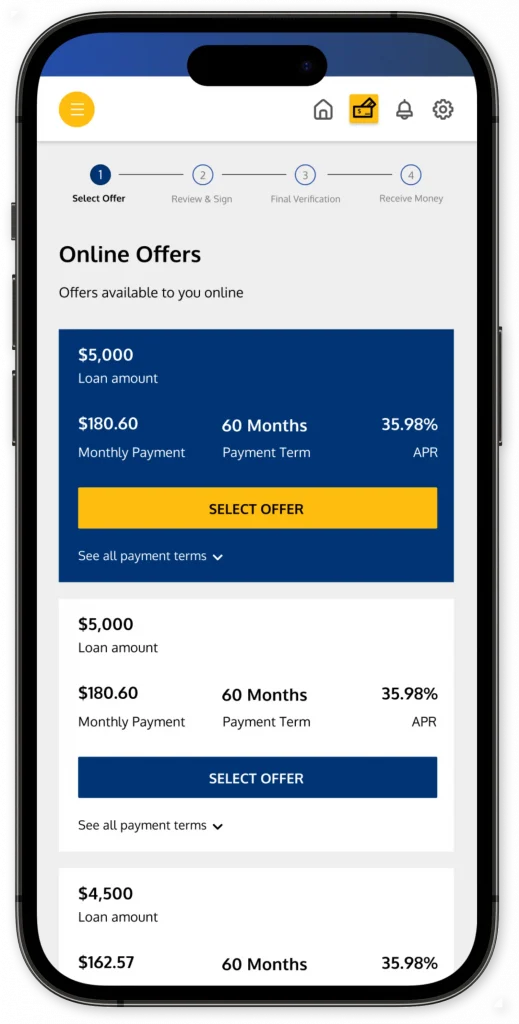

Upon your application submission and approval, we’ll present you with any available personal loan offer(s). We understand that every borrower’s needs and goals are different. So, we customize our offers to meet your needs.

How it works?

Get a quick decision

Apply online in minutes to see if you are approved with no obligation or impact to your credit*.

Check your offers

If approved, review your personalized loan offers.

Get funded

Got questions? We have answers!

You can deposit the check in your bank account or cash it at any other business that cashes checks. Our recommendation is to cash it at the bank where the check is drawn. If you would like to request more money, simply call or visit your local branch. They may be able to help you obtain additional funds.

Mariner Finance does send loan by mail checks to pre-screened, qualified individuals. Although we cannot guarantee the authenticity of all checks you may receive via mail, the loan by mail checks Mariner sends are authentic, simply call the branch phone number on the check to verify that it is real.

For questions regarding a lien release or titles, call the branch where you received your loan.

No, you only pay interest for the amount of time the loan is open.

A local customer service representative can notify you of the date your promotional financing will end. To speak to one, find the branch closest to you.

Call your local branch.

To obtain your account number, contact your local branch.

Prescreened credit offers mailed to qualified consumers include an offer code. With this offer code the consumer can accept the offer online, complete the verification process, and have their funds deposited into their bank account. When using the offer code online, the consumer may also be informed of eligibility for other loan amounts. This offer code needs to be submitted on our offer code page. *

- A copy of a valid, government issued photo ID (e.g. driver’s license or passport)

- Social Security card

- Proof of residence (e.g. a driver’s license with your current address, a utility bill, or a signed lease)

- Proof of income (e.g. paystubs or tax returns)

- Your recent tax return and copy of bank statements (If self–employed)

Yes, subject to underwriting requirements.

No

Yes, valid government issued picture identification is required.

Yes

Application status: To find out the status of your application, call the branch where you applied. They will be able to assist you and answer any other questions you may have about the application process.

An application takes approximately 5 minutes to complete.

You should receive a response usually within the same business day. Please take into account that response time may vary based on application volume and submission time. Any further questions, please call your local branch

No

The minimum loan amount may be as low as $1,000, depending on your state of residency. The maximum loan amount also varies by state†.

We can always determine if you qualify for more money. Simply call your local branch to discuss your current needs.

Yes, contact your local branch to learn more.

No, for your convenience we offer secure online access to your account information through our Customer Account Center or you can contact your local branch for your account information.

Yes, you may pay at any Mariner Finance Branch. You also can always make a payment online through our Customer Account Center

Yes, Mariner Finance does provide automatic payment services. Please login into the Customer Account Center or you can set up automatic payments through your own bank account.

If you have questions about your payment history, login to the Customer Account Center or contact your local branch.

Login to the Customer Account Center or contact your local branchto find out your current balance.

If you are having issues logging into the Customer Account Center, please contact our web support team Monday, Wednesday, Thursday 9am-5pm ET, Tuesday 9am-7pm ET, Friday 9am-5.30pm ET, at (844) 306-7300.

For your convenience, we offer a secure online access to your account information through our Customer Account Center. Creating an account is quick and easy! From the Customer Account Center you can make a single payment, set-up recurring payments, check your balance, and view your payment history. You can also stop by your local branch to pay, or pay by phone from your bank account. Please note that fees may apply for one time online payments or phone payments in some states. No fees will be charged for recurring payments, for in-person payments made at a branch, or for mailed-in payments. If you wish to send a payment by mail, please address payments to Mariner Finance, LLC, P.O. Box 44490, Baltimore, MD 21236 and include your account number.

Mariner Finance reports directly to Equifax, TransUnion, and Experian.

No. Mariner Finance has been an independent company since 2010.

Mariner Finance is a national, branch-based, consumer finance company.

Spreading Smiles Consistently***

Average Customer Rating:

4.8/5

Mariner in the news