5 Things to Know Before Choosing Debt Settlement

When bills pile up and monthly payments become hard to manage, using a debt settlement company might seem like the answer. These companies usually offer

When bills pile up and monthly payments become hard to manage, using a debt settlement company might seem like the answer. These companies usually offer

When bills pile up and monthly payments become hard to

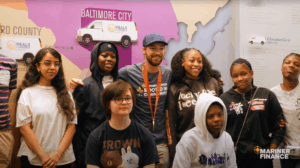

The Mariner Finance team collaborated with Meals on Wheels, local

Rooted in Community: Mariner team members pack 3,600 snack bags

During the annual management meeting, Mariner Finance team members assembled

Mariner Finance, LLC (“Mariner Finance”) and its local Maryland and

Army Veteran Michael Cooper receives a delivery of nutritious food

Free school backpacks were handed out to North Carolina and

Mariner Finance’s North East Philadelphia, PA branch members recently raised

Mariner Finance, LLC (“Mariner Finance”) joined the Maryland Tough Baltimore

Nottingham, Md. — Mariner Finance, LLC (“Mariner Finance”) and its

Credit scores. Many people struggle to understand the ins and