Mariner Finance

Career Benefits

Career Benefits

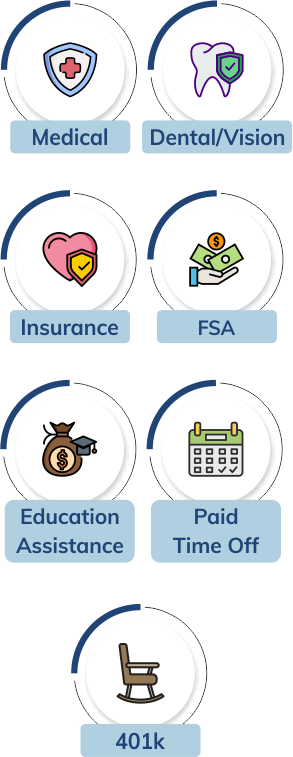

We've got you covered

All full time employees (30 or more hours worked per week) are provided with a generous benefits package in addition to their monetary compensation.

Medical

We provide different health plan options in order to best suit the unique needs of our diverse and growing team. These options include Preferred Provider Organization (PPO) plans, one of which includes eligibility for a Health Savings Account (HSA) funded by quarterly company contributions.

Dental/Vision

Medical care is only a part of an individual’s overall health. In order to provide the members of our team with the most complete healthcare possible, we provide affordable Dental and Vision plans for our employees and their families.

Life, Disability, and AD&D Insurance

Our company-paid term life, AD&D, and long-term disability insurance benefits provide all full-time employees with the security of a financial safety net. A variety of additional voluntary benefit options, including short-term disability insurance, and spouse and child life insurance plans, allow employees to purchase additional coverage for added protection and peace of mind.

Flexible Spending Accounts

It can be difficult to plan for medical expenses that arise unexpectedly, which is why Mariner Finance provides the option of Flexible Spending Accounts (FSA). These accounts allow you to take control of your money (pre-taxed) and use it the way that you need to.

401k

Saving for your retirement is an important part of your financial planning. All employees age 21 or older are immediately eligible to participate in our 401k plan. Mariner Finance matches 100% of the first 3% of eligible compensation contributed to the 401k plan plus 50% of the next 2% contributed. The matching contribution is 100% vested after 2 years of employment.

Education Assistance Program

A successful career begins with the foundations of education, which is why Mariner Finance provides Education Reimbursement Assistance to qualifying employees after 1 year of service.

Paid Time Off

Every employee deserves time away from the workplace to spend with their families and relax in whatever way they see fit. For this reason, Mariner Finance provides ample time off, including:

- A tiered base PTO system with an opportunity to accrue a minimum of 120 hours per year for full-time employees

- 11 paid holidays

Transparency in Coverage

Transparency in Coverage (TiC) requires self-funded plans to post the following machine-readable files (MRFs):

- An in-network rate file, which lists applicable in-network provider rates, including negotiated rates, derived amounts, and underlying fee schedule rates for all covered items;

- An out-of-network rate file, which lists historical data outlining the different billed charges and allowed amounts a plan has paid for covered items or services, including prescription drugs.

Our third party administrator is responsible for maintaining the MRFs at the following link: https://mrf.healthcarebluebook.com/MarinerFinance

Why join

Mariner

Finance

Team

Corporate Culture

Mariner Finance believes that the workplace should have a professional atmosphere and be an enjoyable and comfortable environment that promotes personal health and diligent work ethic.

Benefits

All full time employees (30 or more hours worked per week) are provided with a generous benefits package in addition to their monetary compensation.

Frequently Asked Questions

Want to begin a career with Mariner Finance?

Review Frequently Asked Questions for more career information.