Have you been impacted by lay-offs? Have you lost hours? Mariner Finance is here to provide some helpful resources for you!

While many employers are cutting back on hours and staff, many other employers are hiring!

To help you, Mariner has been compiling a list of companies that have announced that they are hiring. It is published on Mariner’s website and is also available through your branch manager.

In addition, we have compiled a list of helpful tips and resources for you below.

Resume tips:

Today, most resumes are initially screened by computer programs, rather than humans, that look to match resumes to jobs postings using very specific key words. To increase the chances that your resume will be considered, you could consider the following:

- Customize your resume for each job and try to include actual key words from the job posting into the resume;

- Use programs like Microsoft Word, rather than a PDF, HTML, or Apple Pages document, so that key words in your resume can be accurately scanned by computer programs;

Because employers are looking for “soft” skills in addition to technical skills, try to highlight the following skills in your resume, to the extent that they apply:

- Punctuality;

- Time management;

- Teamwork / ability to work on teams;

- Effective communication;

- Adaptability

Helpful tools for resume building:

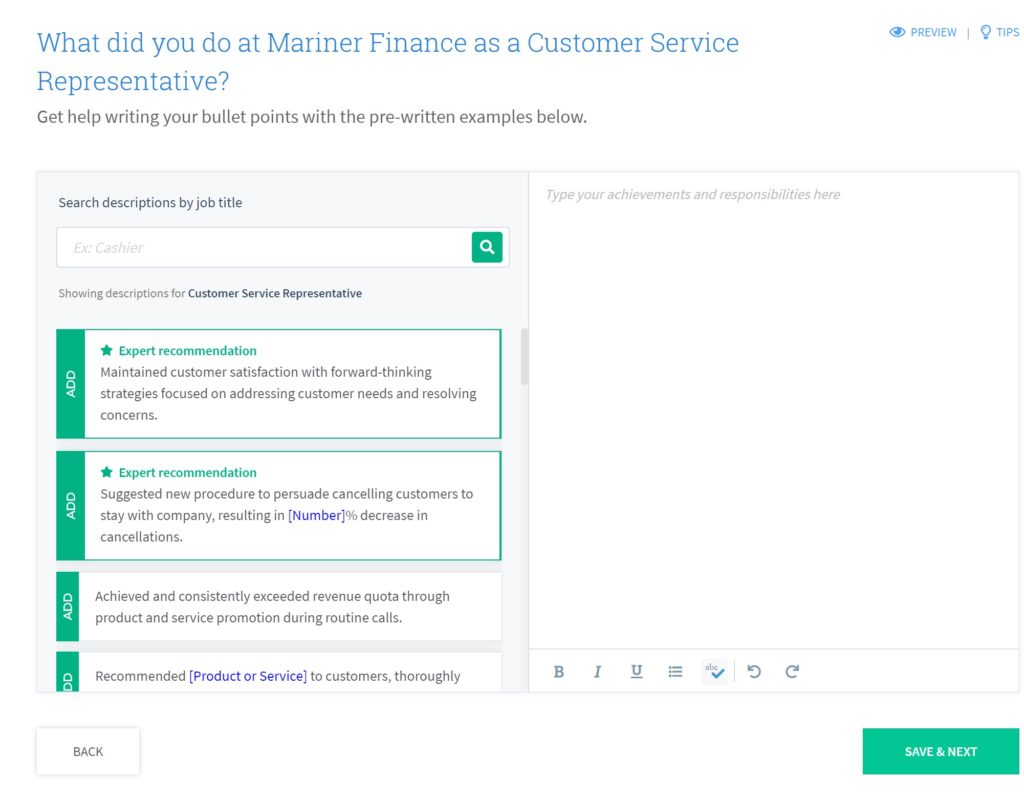

The following website offers expert recommendations on how to word actual job duties for specific job titles, which can help make resume writing very easy! The cite claims that their suggested job duty descriptions are optimized for today’s computer based screening:

https://www.myperfectresume.com/build-resume[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The Jobscan website, linked below, allows a user to compare his/her resume to the job description to help tailor the resume and help increase the chances of the applicant being considered.You can try out their service for 30 days for free.

CareerBuilder provides helpful resources and free resume templates. See the below link for details:

https://www.careerbuilder.com/advice/resumewriting-101-sample-resumes-included