Medical Bills and Their Impact on Your Credit

Find out how medical bills affect your credit and what you can do to maintain your credit score.

What’s the Difference Between a Personal Loan and a Line of Credit?

There are two common ways to borrow money: take out a personal loan or open a personal line of credit. With a personal loan, you are provided a lump sum of money and then required to pay fixed monthly payments. On the other hand, with a line of credit, you are provided access to a […]

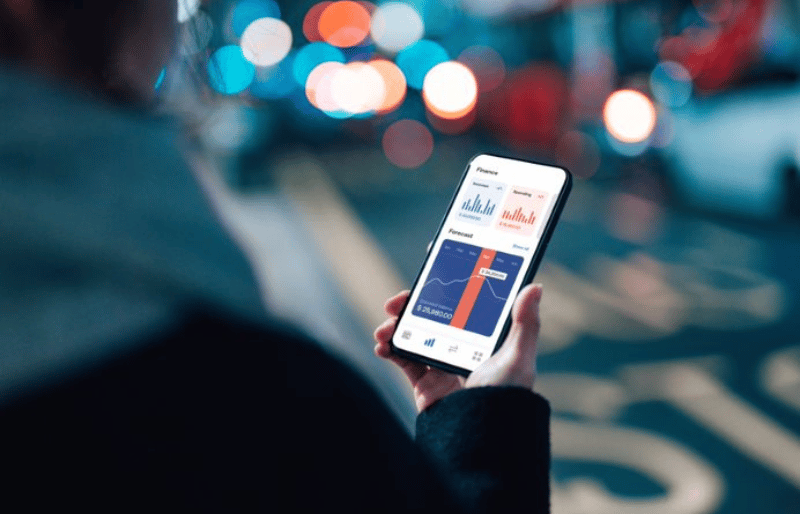

Money Saving Apps: A Go-to Guide to Help You Save Money

12 Apps for your Financial Goals in 2022 In times of high inflation, saving money is especially important to help you stick to a budget and plan for your long-term financial goals. Luckily, there are plenty of modern tools to help you plan, budget, track, and save. From digital money management platforms to apps that […]

What Is a Soft Credit Inquiry?

You probably understand that when you apply for a loan, the lender will check your credit report. You may also know that a credit inquiry could have an adverse effect on your credit score. However, did you know that there are two types of credit checks? One type is referred to as a “hard” credit […]

Why Choose a Local Lender?

From ”Small Business Saturday” to community supported agriculture, there are far-reaching efforts to encourage consumers to think locally. While you may choose the option to purchase produce from a community farm stand, it may not have occurred to you that the same principle can be applied to choosing a financial institution for your personal loan […]

How to Pay for Unexpected Expenses

These seven tips from Mariner Finance will help you pay for unexpected expenses.

Why Is Financial Literacy Important?

Financial literacy is understanding how to manage your personal finances. It includes skills like budgeting, saving, borrowing, investing, and day-to-day money management. According to Standard & Poor’s Global Financial Literacy Survey, only 57 percent of Americans are considered financially literate. If you’re not sure where you fall, consider some of the important components of financial literacy: Financial […]

Top Travel Destinations for Fall Foliage

Fall foliage is the beautiful red, orange, and yellow leaves we see covering trees in the autumn months. These vibrant colors come about as the chlorophyll in the leaves breaks down due to the changes in daylight and temperature. It’s considered peak season for fall foliage when 50 to 75% of trees in an area have turned a shade […]

Back-to-School Shopping for All Ages

Back-to-school shopping can be a very exciting time of year. It can also quickly become stressful, especially if you have kids in different grades. Different grades need different supplies, and the cost can really start to add up. To help ease the stress of back-to-school shopping, we have made a list of common supplies each […]

Top Tips for Planning Your Dream Wedding

You said “I do” to the love of your life and shared the exciting news with close friends and family. Now, the only thing standing between you and forever with your significant other is a wedding. Where do you start? How long does wedding planning take? If you’re here because you’re nervous, overwhelmed, and in […]

What is the Emergency Rental Assistance Program and how may it help?

The Emergency Rental Assistance Program was created to assist households that are unable to pay rent and utilities due to the COVID-19 pandemic. $25 billion in funds are being provided directly to states, U.S. territories, local governments, and Indian tribes (described as “eligible grantees”) to help fund this initiative. If you were unable to pay […]

What is VantageScore®*?

If you’re not familiar with credit scores or just want to know a little bit more about VantageScore®, this article is for you. What is VantageScore®? Created by a joint venture between the big three credit bureaus, Equifax, Experian, and TransUnion, VantageScore® is a credit scoring system developed in 2006. [1] Credit scores can help […]