Your credit score is an extremely important number that directly impacts your ability to obtain any sort of credit such as a personal loan, credit card, mortgage, or car loan. Many people may know what their credit score is, but they may not know what exactly that number means and how it affects them financially.

What is a credit score?

So, what is a credit score? The technical definition is a number assigned to a person that indicates to lenders the probability that a loan will be repaid on time. According to Credit Karma, there are actually over 100 different credit scoring models used in the industry that varies by bureau, reporting agency, model type, and lender. Depending on which outlet lenders use to obtain your credit score, your score may vary slightly.

What is a FICO?

The Fair Isaac Corporation (FICO) is currently the most widely used credit score in the United States. Credit scores produced from the FICO model range from 300-850. The higher the number, the better, or more credit-worthy you are perceived to be by lenders. The breakdown of what is considered to be an excellent, good, fair, and bad credit score are as follows:

- 800+: Exceptional credit

- 740 to 799: Very good credit

- 670-739: Good credit

- 580-669: Fair credit

- 579 and lower: Poor credit

It is important to know that your FICO score can be referred to as three different names; one for each of the three main credit reporting agencies. Each of these agencies refers to their FICO score as follows:

- Equifax– Beacon

- Experian– Experian/FICO risk Model

- TransUnion-Fico Risk Score, Classic

Each of these credit agencies calculate your FICO score based on your credit history they have on file, meaning you can have up to three different FICO scores at one time (hence the three different names). They are all determined using the same FICO calculation though, which makes them each consistent even if they slightly differ.

How is your FICO score determined?

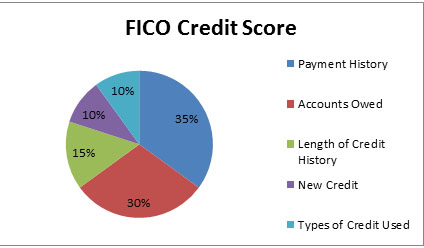

Your FICO score is determined using five components of your credit report:

As you can see, the bulk of your credit score comes from your payment history and how much debt you actually have; those two items account for 65% of your score. So, if you’re really looking to improve your credit score, these are the areas you’ll want to tackle first. This means paying your bills on time, paying off any unpaid debt, and not taking on any additional debt, such as new credit cards or loans, are extremely important when improving your credit score.

Why is it important to know your credit score?

Your credit score is extremely important to know when you are in the market to make a major investment, or any purchase you may need financing or credit for. Credit card companies, insurance companies, and mortgage lenders all pull your credit score and report when deciding if they should provide you with credit, or when deciding what your rates will be. For example, a low credit score (579 or below) would be seen by companies as a “high risk” investment, leading them to either deny the claim or charge a high interest rate to compensate for the high risk.

Knowing your score before you plan on making a major investment, such as a student loan, mortgage loan, and insurance coverage, will give you an idea of what rates you will qualify for and which companies will accept your claim. A general rule of thumb is that the higher your credit score, the lower your rates will usually be, and the lower your score, the higher your rates will usually be.

Did you like this content? You may also be interested in our article Understanding your credit risk.