Use this simplified listing to stay on top of this tax season’s deadlines. Keep in mind, these are not the only deadlines for tax season and dates for tax deadlines change each year.

January January 17th: Deadline to pay your fourth quarter estimated tax payment for the year 2016. *Tip: You can skip this estimated payment without penalty if you file your return and pay your balance in full by February 1, 2017.

January 23th: Opening day to file 2016 individual tax returns.

February February 1st: Deadline for self-employed individuals to file and to pay their taxes in order to avoid a penalty if they do not make their fourth quarter estimated tax payment. *Tip: You should receive a W-2 form from your employer by this date in order to file taxes for 2016. If you do not receive a W-2 form by this date, you should contact your employer immediately. February 15th: Deadline for employees who claim exemption from withholding to file a new W-4 form with their employers.

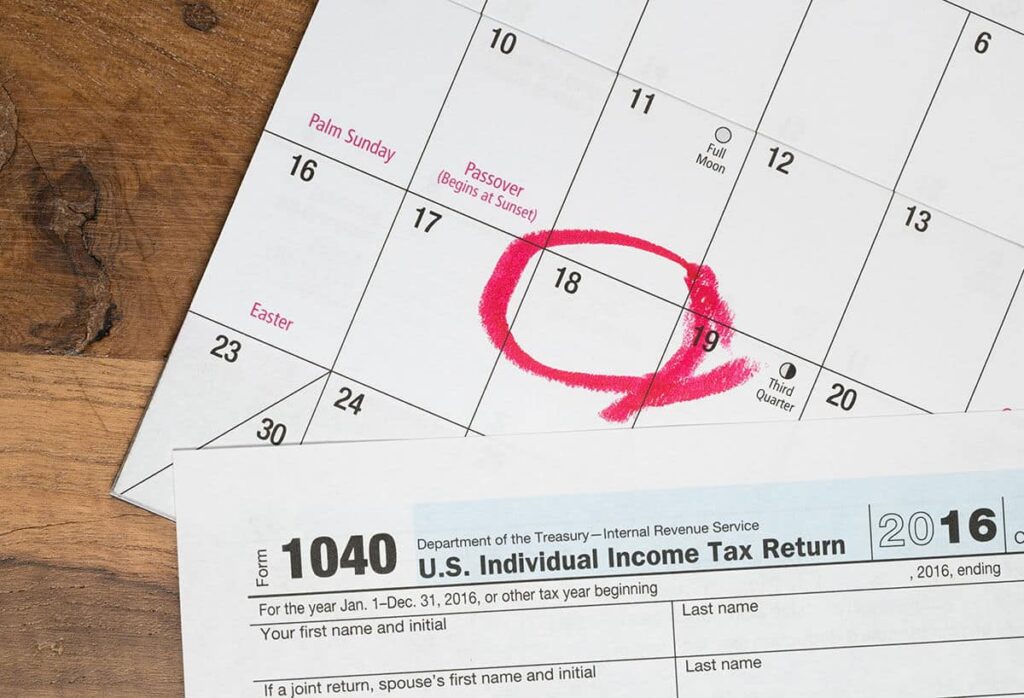

April April 18th: Deadline to file individual tax returns (Form 1040, 1040A, or 1040EZ) for the year 2016, or to request an automatic extension (Form 4868). *Tip: An extension provides an extra six months to file your return, but payment of the tax is still due by April 18th. You can submit payment for tax along with the extension form.

Last day to make a contribution to traditional IRA, Roth IRA, Health Savings Account, SEP-IRA, or solo 401k for the 2016 tax year.

First quarter estimated tax payments due for the 2016 tax year.

Final deadline to file an original tax return (Form 1040) and amended tax return (Form 1040X) for the tax year 2016 and still claim a tax refund. *Tip: Make sure to mail the amended return well before April 18th to guarantee your tax refund will be processed in a timely manner. In addition, obtain proof of mailing, such as a certified mail receipt, for your records.

Deadline to file estate income tax or trust income tax returns (Form 1041), or to request an automatic five-month extension of time to file (Form 7004).

Deadline to file partnership tax returns (Form 1065), or to request an automatic five month extension of time to file (Form 7004).

Final deadline for estates, trusts, or partnerships to file an amended tax return and still claim a tax refund for the year 2016.

Source: Tax Calendars for 2017 (IRS Publication 509)

Sources: Tax Calendars for use in 2016 (IRS Publication 509) and About Money