This check from Mariner Finance represents a loan offer

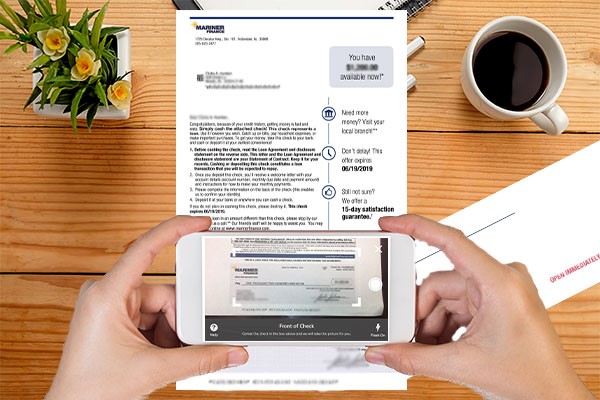

You received this check because of your credit history. To receive your funds, take the check to your bank and cash or deposit it, or deposit it with your mobile device at your earliest convenience!*

No lines. No waiting. Simply deposit or cash your check.

If, for any reason, you are dissatisfied with your loan, we offer a 15-day satisfaction guarantee!†

How does it work?

It’s as easy as 3 steps…

- Read the loan agreement. Before cashing the check be sure to read the loan agreement and disclosure statements included in the mailing. This information provides all of the terms of the loan. Keep this information for your records. Cashing or depositing the check constitutes a loan transaction that you will be obligated to repay.

- Fill out and sign the back of the check. If you agree to the terms and want to take out the loan, provide the requested information and sign the back of the check!

- Deposit or cash the check to receive the loan proceeds!

Who is Mariner Finance?

Since 1927, the Mariner Finance family of companies have provided individually tailored and convenient lending options to its customers with the goal of pairing them with a personal loan that meets their immediate needs. At the core of Mariner Finance is the principle that superior customer service will build lasting relationships. Our experienced team members take pride in finding options that are beneficial to each customer’s specific needs and are ready to assist you. Superior customer service is the reason for our continued success and why we are recognized by our customers as the community’s consumer finance company of choice.

Who cashes Mariner Finance checks? Customer Stories

“The loan check arrived in the mail just when I had been advised that my car needed some serious unexpected repairs. At the time I had no idea how I was going to pay for repairs on my own so I took a chance and deposited the Mariners check into my account.”

– Brenda

“It was just what I needed at that very moment! I was not stressing over will I qualify for a loan. No one was pressuring me. I took the time to read the fine print and time to look at my ability to repay the loan. I put it away and reviewed my options.”

– Patricia

Frequently asked questions about Mariner Finance checks?

Q. I received a check from Mariner Finance, is it real?

A. Yes, Mariner Finance does send live checks to pre-screened, qualified individuals. Although we cannot guarantee the authenticity of all checks you may receive via mail, simply call the branch phone number on the letter with the check to verify that it is real.

Q. Where can I cash a check that I have received from your company?

A. You can deposit the check in your bank account or cash with your bank or at any other business that cashes checks. If you would like to request more money, simply call or visit your local branch. They may be able to help you obtain additional funds. **

Q. If I pay my loan off early do I have to pay interest for the entire length of the loan?

A. No, you only pay interest until the loan is paid-in-full.

Q. If I’m not interested in the check what should I do?

A. If you do not plan on cashing this check, please destroy it.

Still have questions?

Your local branch is happy to answer questions you may have. Find a branch near you or call 844-306-7300.

Hours: 9am – 5pm ET (Monday – Friday)

(Extended Hours: 7 p.m. on Tuesday and 5:30 p.m. on Friday)

![]()

*We have the right to stop payment on the check if you have opened or renewed a loan with us within 60 days prior to the date of the check.

Prohibited Use of Proceeds – Loan proceeds may not be used for business or commercial purposes, to finance direct post-secondary education expenses, for purchase of securities, for gambling or any illegal purpose.

**Additional credit or other loan amounts are subject to normal lending requirements.

+If, for any reason, you are dissatisfied with your loan and repay it in full within 15 days, we will waive all finance changes with no penalties. Your repayment amount must be in the form of cash or certified funds.